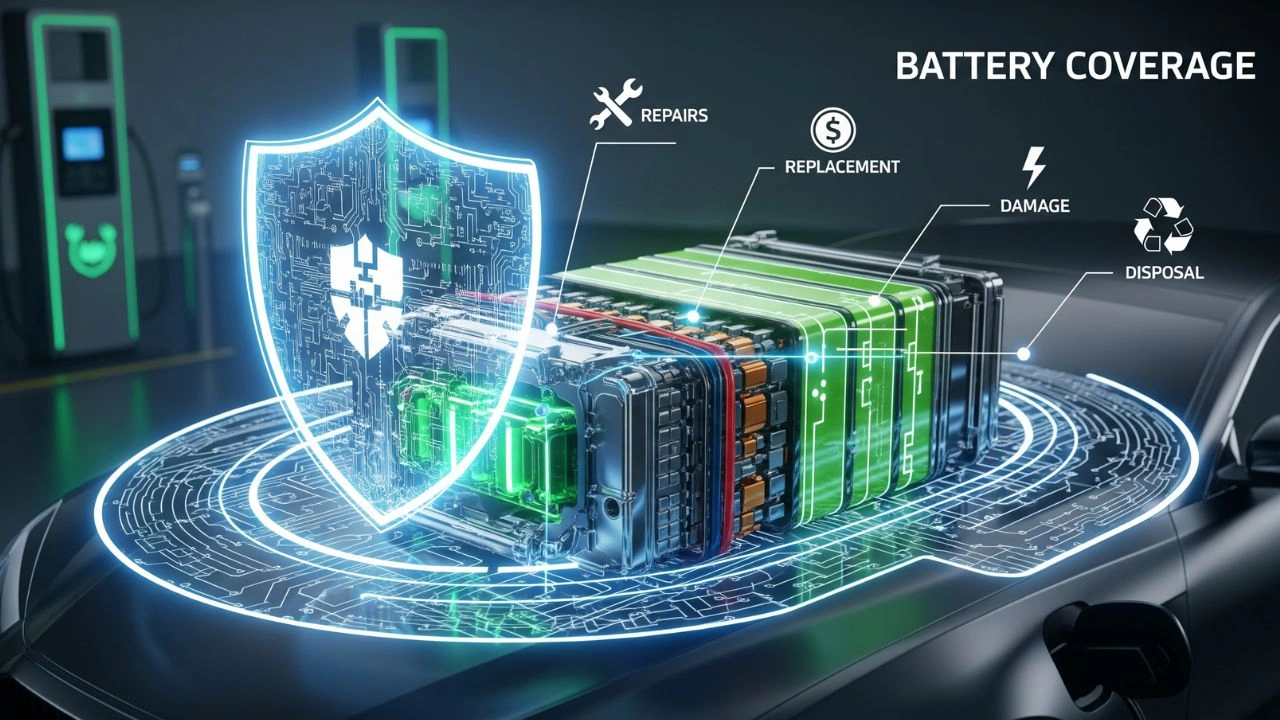

Battery Coverage in EV Insurance: Electric vehicles are often promoted as the future of mobility—cleaner, quieter, and cheaper to maintain. While this is largely true, one critical cost factor is frequently misunderstood or completely overlooked by buyers: battery replacement and how it is covered under EV insurance policies. For many owners, the battery is not just another component; it is the single most expensive part of the vehicle, sometimes accounting for nearly half of its total value.

Insurance brochures and policy summaries often mention “battery coverage” in vague terms, leaving EV owners with a false sense of security. When a real-world claim arises—after an accident, fire, flood, or even a manufacturing defect—policyholders are often shocked to discover what is not covered, what is depreciated, and what they must pay out of pocket.

This in-depth article explores the realities of battery coverage in EV insurance, uncovers the fine print most policies don’t highlight, and explains what every EV owner should know before assuming they are fully protected.

Why the EV Battery Is So Different From Any Other Car Component

In traditional internal combustion engine (ICE) vehicles, the engine is complex but repairable. Parts can be replaced individually, rebuilt, or sourced from multiple suppliers. EV batteries, by contrast, are sealed, high-voltage systems designed as integrated units.

Key characteristics that make EV batteries unique include:

- High replacement cost

- Limited repairability

- Strict safety protocols

- Manufacturer-controlled diagnostics

- Rapid technological evolution

Because of these factors, insurers treat batteries differently from engines or gearboxes in ICE vehicles. A damaged battery is often considered a “replace, not repair” component, dramatically increasing claim severity.

The Real Cost of EV Battery Replacement

Battery replacement costs vary widely depending on vehicle brand, capacity, and chemistry, but the numbers are consistently high.

Typical replacement cost ranges:

- Entry-level EVs: $6,000–$10,000

- Mid-range EVs: $12,000–$20,000

- Premium EVs: $25,000 or more

These figures usually exclude labor, calibration, software updates, and disposal fees, which insurers may or may not cover.

For comparison, replacing an ICE engine often costs less than half the price of a premium EV battery and offers more repair flexibility.

Read Also: Vayve Mobility Eva: India’s First Solar-Powered Electric Car Aiming to Transform Urban Mobility

What “Battery Coverage” Actually Means in Most EV Insurance Policies

Many EV owners assume battery coverage means full replacement at any time. In reality, battery coverage is highly conditional.

Most standard EV insurance policies cover battery damage only if it results from:

- A covered accident

- Fire or explosion

- Flood or natural disaster

- Theft or vandalism

However, battery degradation, reduced range, or performance loss is almost never covered under standard insurance.

This distinction is critical: insurance covers sudden damage, not gradual decline.

Accidental Damage vs Battery Failure: A Crucial Difference

Insurance policies focus on accidental loss, not mechanical or chemical failure. This means:

- A battery damaged in a collision may be covered

- A battery that fails due to internal cell degradation is not

Even if battery failure renders the vehicle unusable, insurers often classify it as wear and tear, which is excluded from coverage.

This gap leaves many EV owners relying on manufacturer warranties rather than insurance.

Manufacturer Battery Warranties Are Not Insurance

Most EV manufacturers offer battery warranties, typically:

- 8 years or

- 100,000 to 160,000 kilometers

These warranties usually guarantee:

- Minimum capacity retention (often 70%)

- Coverage against manufacturing defects

However, manufacturer warranties do not cover accident damage, flooding, fires caused by external factors, or misuse. That’s where insurance is expected to step in—but the overlap is far from seamless.

Owners often discover too late that:

- Warranty and insurance coverage do not align

- Gaps exist between defect coverage and damage coverage

Depreciation: The Silent Cost Most Policies Don’t Highlight

One of the least understood aspects of EV battery insurance is depreciation.

In many markets, insurers apply:

- Age-based depreciation

- Usage-based depreciation

This means that even if battery replacement is approved, the insurer may only pay the depreciated value, not the cost of a new battery.

For example:

- A 5-year-old EV with a $15,000 battery

- Depreciation applied at 50%

- Insurer pays $7,500

- Owner pays the remaining $7,500

This single clause can turn a “covered” claim into a massive financial burden.

Total Loss Decisions Driven by Battery Damage

Battery damage is one of the main reasons EVs are declared total losses.

Why this happens:

- Battery replacement exceeds a set percentage of vehicle value

- Structural battery packs compromise chassis integrity

- Insurers prefer total loss settlements to complex repairs

Even minor accidents involving battery housings can result in write-offs, leaving owners with settlement values that may not match outstanding loans.

Flood and Water Damage: A Major EV Battery Risk

Flooding is particularly dangerous for EV batteries. While most are sealed and water-resistant, prolonged immersion or contaminated water exposure can cause irreversible damage.

Insurance complications include:

- Mandatory battery replacement for safety

- Disputes over water ingress timelines

- Increased fire risk after flooding

Many policies cover flood damage, but insurers may require extensive inspections, delaying settlements and increasing inconvenience.

Fire Risk and Battery Replacement Claims

EV battery fires are rare, but when they occur, they are costly.

Insurance challenges include:

- Determining the cause of the fire

- Distinguishing between external impact and internal failure

- Managing re-ignition risks

Some insurers impose stricter terms or higher deductibles for fire-related battery claims due to the severity and complexity involved.

Charging-Related Damage: A Grey Area in Many Policies

Damage caused during charging is one of the most misunderstood coverage areas.

Possible scenarios:

- Power surges damaging battery cells

- Faulty home chargers causing overheating

- Public charging station malfunctions

Many standard policies do not clearly specify whether such incidents are covered. Some classify them as electrical failures rather than accidents, potentially denying claims.

Aftermarket Modifications and Their Insurance Impact

Any modification to the battery system—software tuning, third-party battery replacements, or capacity upgrades—can severely affect coverage.

Insurers may:

- Void battery-related claims

- Reduce payout amounts

- Reject coverage entirely

EV owners should always declare any battery-related modifications, even software changes, to avoid claim rejection.

Specialized EV Insurance Add-Ons: Are They Worth It?

To address coverage gaps, some insurers now offer:

- Zero-depreciation battery cover

- Battery replacement riders

- Charging equipment insurance

These add-ons increase premiums but significantly reduce financial exposure. For high-value EVs, such riders can be the difference between manageable claims and catastrophic costs.

Geographic Factors That Influence Battery Coverage

Where you live matters more for EV insurance than many realize.

Insurers assess:

- Flood-prone zones

- Extreme temperature regions

- Charging infrastructure reliability

High-risk areas often come with:

- Higher premiums

- Stricter battery exclusions

- Increased deductibles

The Role of Data and Telematics in Battery Risk Assessment

Some insurers now use vehicle data to monitor:

- Charging patterns

- Thermal events

- Battery stress indicators

While this can lead to lower premiums for responsible users, it also raises concerns about claim scrutiny and data-driven denial decisions.

What Most Policy Documents Don’t Explicitly Say

Insurance documents are often written in broad language. What they don’t clearly state includes:

- Exact depreciation formulas for batteries

- Conditions triggering total loss decisions

- Coverage exclusions tied to charging behavior

- Battery storage and post-accident handling rules

Understanding these hidden clauses requires careful reading or professional advice, something many buyers skip at purchase time.

How EV Owners Can Protect Themselves

To avoid unpleasant surprises, EV owners should:

- Ask for written clarification on battery coverage

- Opt for zero-depreciation or battery-specific riders

- Understand warranty vs insurance boundaries

- Regularly review policy updates

- Choose insurers experienced with EV claims

Being proactive is essential because battery-related claims are among the most expensive and disputed in EV insurance.

Read Also: Ultraviolette F77: India’s High-Performance Electric Motorcycle That Redefined Electric Riding

The Future of Battery Insurance Coverage

As EV adoption accelerates, insurers are under pressure to evolve.

Expected trends include:

- Modular battery repair acceptance

- Battery health-based premiums

- Standardized battery valuation models

- Closer insurer–manufacturer collaboration

However, until these changes become widespread, battery replacement costs will remain a major blind spot for many EV owners.

Conclusion: Knowledge Is the Best Coverage

EVs represent a revolutionary shift in transportation, but insurance frameworks are still catching up. Battery coverage is not as comprehensive as many buyers assume, and replacement costs can be financially devastating without the right protection.

Understanding what your policy doesn’t explicitly promise is just as important as knowing what it does. In the world of electric vehicles, battery awareness is no longer optional—it is essential.

A well-informed EV owner is far less likely to face unexpected costs and far more likely to enjoy the true benefits of electric mobility with confidence and peace of mind.