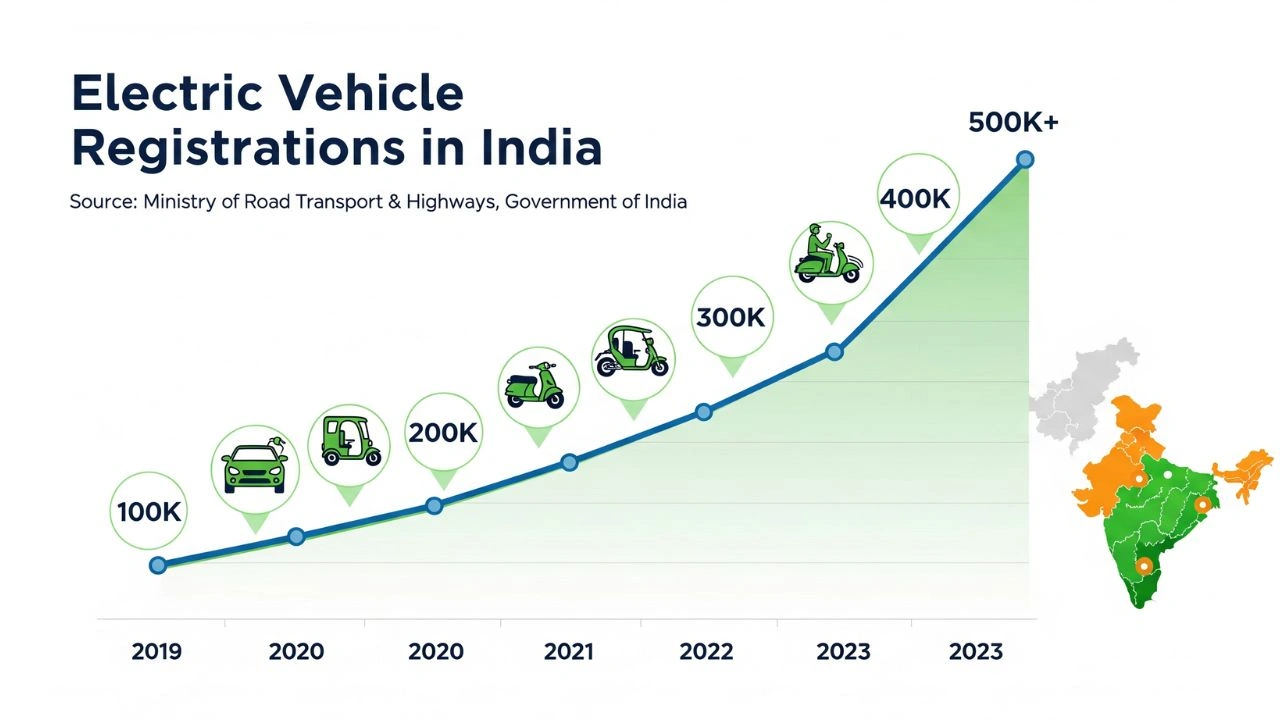

EV registrations in India: India’s electric mobility journey gains remarkable momentum as EV registrations stay above two lakh units, reflecting confidence, infrastructure growth, and policy support.

India’s transition toward electric mobility reached another significant milestone in January as electric vehicle (EV) registrations crossed the 2 lakh mark for the fourth consecutive month, reaffirming the sector’s steady upward trajectory. Despite lingering challenges such as price competition from internal combustion engine (ICE) vehicles and infrastructure gaps in certain regions, the sustained performance highlights a structural shift in consumer preferences and industry direction.

The continued growth comes at a time when the Indian automobile market is witnessing intense transformation, driven by environmental concerns, fuel cost volatility, and strong policy signals encouraging cleaner transportation. January’s numbers not only indicate demand resilience but also underscore how electric vehicles are gradually moving from niche adoption to mainstream acceptance.

A Strong Start to the Year for India’s EV Market

January traditionally sets the tone for automotive trends in India, and the EV sector has started the year on a notably strong footing. More than 2 lakh electric vehicles were registered nationwide, continuing a streak that began four months earlier. This consistency is particularly important because it reflects demand stability rather than a one-time surge influenced by seasonal discounts or year-end incentives.

Compared to the same period last year, EV registrations have recorded a substantial year-on-year increase. Industry observers point out that this growth is not limited to a single category or region; instead, it is spread across two-wheelers, three-wheelers, and passenger vehicles, indicating broad-based adoption.

This performance also suggests that buyers are becoming increasingly comfortable with electric mobility, supported by greater product availability, improved range capabilities, and expanding charging infrastructure across urban and semi-urban areas.

Read Also: EV Mitra Scheme 2025 India: Subsidy, Benefits, Eligibility & How to Apply

Why Crossing 2 Lakh Units Consistently Matters

The fact that EV registrations have crossed 2 lakh units for four straight months is more than just a statistical achievement. It marks a psychological threshold for both consumers and manufacturers.

For consumers, repeated high registration figures signal reliability, social acceptance, and reduced perceived risk associated with EV ownership. For manufacturers and investors, it demonstrates that India’s EV demand is no longer experimental but scalable, justifying further investments in production, localization, and technology development.

Additionally, policymakers view this trend as validation of long-term strategies aimed at reducing carbon emissions, lowering oil imports, and promoting domestic manufacturing under initiatives such as Make in India.

Electric Two-Wheelers Continue to Lead the Charge

Among all EV segments, electric two-wheelers remain the dominant force, accounting for the largest share of registrations in January. Affordable pricing, low running costs, and suitability for daily commuting make electric scooters and motorcycles particularly attractive to Indian consumers.

Urban commuters, delivery partners, and young professionals have increasingly embraced electric two-wheelers due to rising petrol prices and minimal maintenance requirements. The availability of multiple models across different price points has also helped address earlier concerns related to affordability and choice.

Manufacturers have responded by continuously improving battery efficiency, offering fast-charging options, and introducing smart features such as connected dashboards and mobile app integration. These enhancements have strengthened the value proposition of electric two-wheelers, making them competitive with traditional petrol models.

Passenger Electric Vehicles Gain Steady Ground

While electric cars still represent a smaller portion of total EV registrations compared to two-wheelers, the passenger EV segment is steadily gaining traction. January saw healthy registration numbers for electric cars and SUVs, reflecting growing interest among middle-class and premium buyers.

Factors contributing to this growth include improved driving range, better charging networks in metropolitan areas, and increasing brand trust in established automakers offering electric models. Corporate buyers and fleet operators are also playing a crucial role by adopting electric cars for sustainability goals and long-term cost savings.

Although upfront costs remain higher than ICE vehicles, buyers are increasingly evaluating total cost of ownership, where lower fuel and maintenance expenses often tilt the balance in favor of EVs over time.

Three-Wheelers and Commercial EVs Drive Practical Adoption

Electric three-wheelers, particularly e-rickshaws and cargo carriers, continue to be a strong pillar of EV growth in India. These vehicles are widely used for last-mile connectivity and goods transport, especially in urban and semi-urban areas.

The popularity of electric three-wheelers stems from lower operating costs, simple mechanics, and suitability for high-usage commercial applications. Government incentives and state-level policies have further accelerated adoption among small business owners and self-employed drivers.

In the commercial segment, electric light commercial vehicles (LCVs) are also gaining visibility, driven by logistics companies and e-commerce platforms seeking sustainable and cost-efficient transport solutions.

Impact of Policy Support and Government Incentives

Government policy has played a critical role in shaping India’s EV growth story. Central and state governments have introduced a range of incentives, including purchase subsidies, tax benefits, reduced registration fees, and support for charging infrastructure development.

Even as certain subsidies have been recalibrated over time, the overall policy direction remains supportive of electric mobility. Clear long-term targets for EV adoption provide confidence to manufacturers, suppliers, and consumers alike.

Additionally, regulatory measures aimed at tightening emission norms for ICE vehicles indirectly encourage buyers to consider electric alternatives. The consistent crossing of the 2 lakh registration mark suggests that policy signals are translating into real-world adoption.

Competition from ICE Vehicles and Market Challenges

Despite strong growth, the EV sector continues to face competition from traditional petrol and diesel vehicles. Temporary price advantages in ICE vehicles, driven by tax adjustments or promotional offers, can influence short-term buying decisions.

Infrastructure limitations also remain a concern, particularly in rural areas and smaller towns where charging availability is limited. Range anxiety, though gradually reducing, still affects first-time buyers considering electric cars.

However, industry experts argue that the sustained EV registration streak indicates resilience against these challenges. As infrastructure improves and technology costs decline, the competitive balance is expected to increasingly favor electric mobility.

Role of Charging Infrastructure Expansion

One of the most significant enablers of EV adoption is the expansion of charging infrastructure. Public and private players are investing heavily in setting up fast-charging stations along highways, in residential complexes, workplaces, and commercial hubs.

State governments and municipal bodies are also mandating EV-ready infrastructure in new buildings, which is expect to ease access to charging facilities over the long term. For two-wheelers and three-wheelers, home charging continues to be a convenient and cost-effective solution.

The consistent rise in registrations suggests that charging accessibility is improving sufficiently to support higher EV volumes, particularly in major cities.

Consumer Mindset: From Curiosity to Confidence

Early EV adoption in India was largely driven by curiosity and environmental consciousness. Today, the narrative has evolved toward practical benefits such as cost savings, convenience, and long-term reliability.

Consumers are increasingly inform, comparing specifications, warranties, charging options, and resale value before making purchasing decisions. Positive word-of-mouth from existing EV owners has also played a crucial role in building trust.

The four-month streak of registrations above 2 lakh units reflects this shift in mindset, indicating that electric vehicles are becoming a default consideration rather than an alternative option.

Industry Response and Manufacturing Push

Automakers are responding to growing demand by expanding production capacity, localizing components, and introducing new models across segments. Battery manufacturing, in particular, has emerged as a strategic focus area, with investments aimed at reducing dependence on imports and lowering costs.

Startups and established players alike are innovating in areas such as battery swapping, energy management software, and lightweight vehicle design. This innovation ecosystem is strengthening India’s position in the global EV value chain.

Consistent monthly demand provides manufacturers with the confidence needed to scale operations and invest in long-term research and development.

Environmental and Economic Implications

The sustained rise in EV registrations has positive implications beyond the automotive sector. Reduced reliance on fossil fuels helps lower greenhouse gas emissions and improve urban air quality.

Economically, EV adoption contributes to energy security by reducing oil imports and supports job creation in emerging sectors such as battery manufacturing, charging infrastructure, and power electronics.

As EV penetration increases, these benefits are expect to multiply, reinforcing the strategic importance of electric mobility for India’s sustainable development goals.

Read Also: Car Insurance Renewals Are Changing in 2026: New Rules, New Risks, New Savings

Outlook for the Coming Months

Looking ahead, industry analysts expect the EV market to maintain its growth momentum, supported by upcoming model launches, continued infrastructure development, and favorable policy frameworks.

While monthly fluctuations are possible due to seasonal factors, the broader trend suggests that crossing 2 lakh registrations may soon become the norm rather than the exception.

If current trajectories continue, India could witness even higher monthly EV registrations by the end of the year, further accelerating the transition toward cleaner transportation.

Conclusion: A Defining Phase for Electric Mobility in India

The achievement of four consecutive months with EV registrations above 2 lakh units marks a defining phase in India’s electric mobility journey. It reflects growing consumer confidence, maturing industry capabilities, and supportive policy ecosystems working in tandem.

As challenges are addressed and opportunities expand, electric vehicles are poised to play an increasingly central role in India’s transportation landscape. January’s performance is not just a strong start to the year—it is a signal that electric mobility in India is moving firmly into the mainstream.