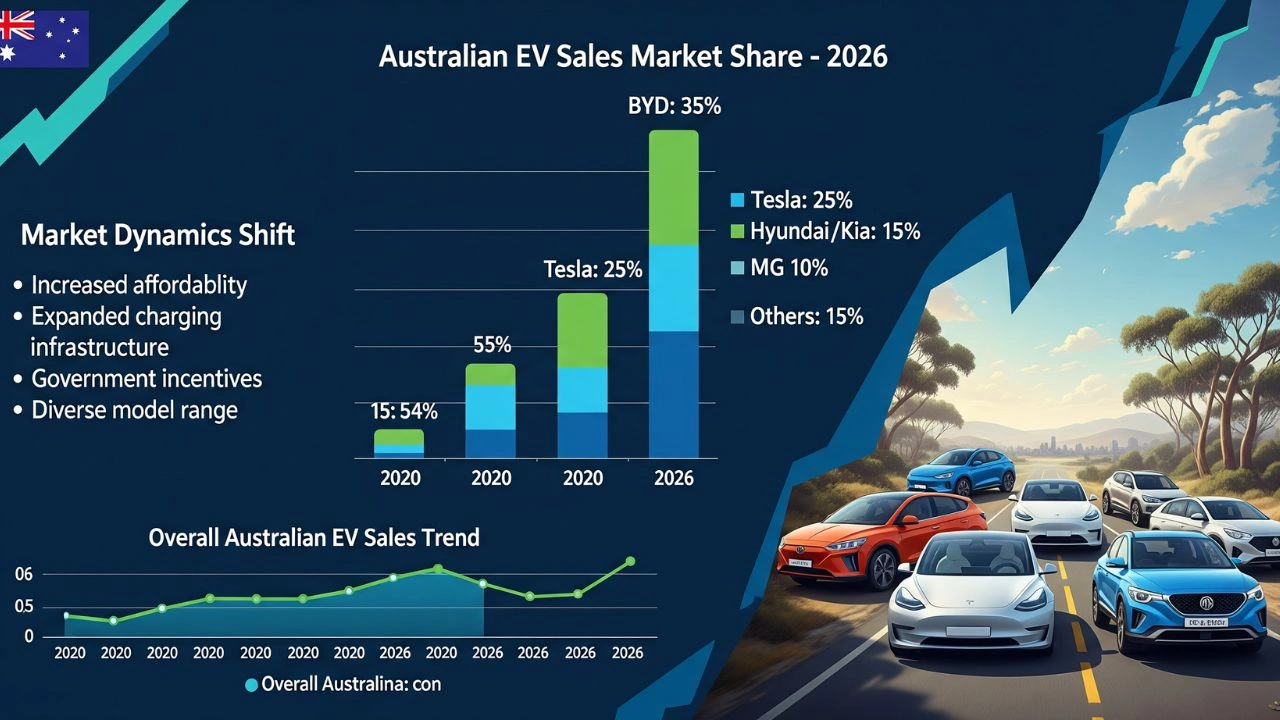

Australian EV sales 2026: Australia’s electric vehicle market enters a new phase in 2026 as sales data shows shifting brand dominance, rising Chinese influence, and evolving consumer preferences.

Australia’s electric vehicle (EV) market is undergoing a profound transformation in 2026, with monthly sales data revealing not only steady demand but also a significant reshaping of brand leadership and consumer choice. January 2026 figures highlight how the market has matured beyond early adoption, with a wider range of electric models, intense competition, and a clear move toward affordability and value-driven purchases.

The latest monthly breakdown of EV sales by model and brand provides a detailed snapshot of how Australians are embracing electric mobility—and which manufacturers are successfully capturing that demand. With nearly 7,000 battery electric vehicles sold in a single month, the Australian EV market is no longer defined by a handful of premium players, but by a diverse lineup of brands, many of them new to the country.

January 2026 Sets the Tone for the Australian EV Market

January often serves as an indicator of broader automotive trends, and the first month of 2026 has set a revealing tone for Australia’s EV landscape. Sales data shows strong participation across multiple brands and price segments, suggesting that electric vehicles are steadily becoming a mainstream choice rather than a niche alternative.

Unlike earlier years when Tesla dominated monthly charts almost unchallenged, January 2026 reflects a far more competitive and fragmented market. Consumers now have access to a broader selection of electric SUVs, sedans, and compact vehicles, many of which offer compelling specifications at competitive prices.

This diversification is reshaping buyer behavior, with Australians increasingly prioritizing value, practicality, and availability over brand legacy alone.

Read Also: Electric Vehicle Subsidies in India: A Complete Guide 2026

BYD Emerges as the Clear Market Leader

One of the most striking insights from January 2026 sales data is the dominant position of BYD in the Australian EV market. The Chinese automaker recorded the highest total sales among all brands, comfortably outperforming traditional leaders and newer entrants alike.

BYD’s success is driven by a multi-model strategy that addresses different consumer needs. From compact urban vehicles to larger family-oriented SUVs, the brand has positioned itself as a versatile and accessible option for a wide audience.

Importantly, BYD’s strong performance underscores a broader trend: Australian consumers are increasingly open to Chinese automotive brands, particularly when they deliver strong technology, competitive pricing, and reliable range.

BYD Sealion 7 Leads the Model Rankings

At the individual model level, the BYD Sealion 7 emerged as the best-selling electric vehicle in Australia for January 2026, registering over a thousand units in a single month. This performance highlights the growing popularity of mid-size electric SUVs, which align well with Australian driving habits and lifestyle preferences.

The Sealion 7’s appeal lies in its combination of range, interior space, and modern design, making it attractive to families and long-distance drivers alike. Its success also reflects BYD’s ability to rapidly scale supply and meet demand—an advantage that has proven crucial in a competitive market.

Compact and Mid-Size EVs Gain Momentum

Beyond the top-selling model, sales rankings reveal strong demand for compact and mid-size electric vehicles, particularly those offering a balance between affordability and performance.

Models such as the BYD Atto series, Geely EX5, and Zeekr 7X demonstrate that buyers are actively exploring alternatives beyond traditional Western and Japanese brands. These vehicles cater to urban commuters as well as suburban households, offering flexible use cases and manageable ownership costs.

This trend suggests that the Australian EV market is broadening at the middle, rather than being driven solely by high-end or luxury offerings.

Tesla’s Position Reflects a Changing Market Dynamic

Tesla remains a significant player in Australia’s EV market, but January 2026 data indicates a shift in its relative dominance. While the Tesla Model Y and Model 3 continue to register solid monthly sales, the brand no longer occupies the top positions by default.

This change does not necessarily reflect declining interest in Tesla, but rather the rise of credible competitors offering similar range and features at more accessible price points. Increased competition has given consumers more options, reducing reliance on a single brand.

Tesla’s experience highlights a key reality of maturing EV markets: early leadership does not guarantee long-term dominance.

Kia and Traditional Brands Maintain a Steady Presence

Among established automakers, Kia stands out as one of the strongest performers, maintaining a consistent level of EV sales in January 2026. Kia’s electric offerings benefit from brand familiarity, dealer networks, and a reputation for reliability.

Other traditional manufacturers, including Toyota, Volkswagen, BMW, Mercedes-Benz, and Hyundai, also recorded monthly EV sales, though at more modest levels. Their presence indicates ongoing participation in the EV transition, even if volume growth remains gradual.

For these brands, the challenge lies in balancing premium positioning with price sensitivity, particularly as new entrants continue to disrupt the market.

The Rising Influence of New and Emerging Brands

January 2026 sales figures underline the growing influence of new and lesser-known EV brands in Australia. Manufacturers such as Zeekr, Geely, Omoda Jaecoo, and Deepal are carving out space in a market once dominated by a few familiar names.

These brands often compete on technology, features, and pricing, appealing to consumers who are less brand-loyal and more focused on specifications and value. Their success signals a broader shift in how Australians approach car buying in the electric era.

As awareness increases and dealer networks expand, these emerging players are likely to become even more prominent.

Total EV Sales Reflect a Market in Transition

With nearly 6,900 battery electric vehicles sold in January 2026, the Australian EV market demonstrates both resilience and momentum. While overall penetration still trails some global peers, the steady flow of monthly sales suggests that adoption is becoming more predictable and sustainable.

This level of volume also supports further investment in charging infrastructure, service networks, and localized support, reinforcing the EV ecosystem as a whole.

Charging Infrastructure Shapes Consumer Confidence

Infrastructure remains a critical factor influencing EV adoption in Australia. January’s sales performance reflects growing confidence in public charging availability, particularly along major highways and within metropolitan areas.

Government initiatives and private-sector investment have expanded fast-charging networks, reducing range anxiety and enabling longer journeys. For many buyers, improved infrastructure has transformed EV ownership from a city-only solution to a viable nationwide option.

As charging continues to expand, it is expected to unlock further demand, especially in regional areas.

Pricing and Value Drive Buyer Decisions

One of the clearest themes emerging from January 2026 data is the importance of pricing and perceived value. Many of the top-selling models offer competitive pricing relative to their specifications, challenging the notion that EVs must carry a premium.

Lower operating costs, combined with improving resale value expectations, have strengthened the economic case for electric vehicles. Buyers are increasingly calculating total cost of ownership, rather than focusing solely on purchase price.

This shift benefits manufacturers that can deliver efficient production, localized supply chains, and scalable platforms.

Consumer Preferences Are Evolving Rapidly

Australian EV buyers in 2026 are more informed than ever. They compare range, charging speed, warranty coverage, software updates, and safety features before making decisions.

The popularity of SUVs reflects lifestyle preferences, while the continued presence of compact EVs highlights urban practicality. This diversity of demand underscores the importance of model variety in sustaining market growth.

Manufacturers that fail to adapt to these evolving preferences risk losing relevance in an increasingly competitive environment.

Environmental and Policy Context

EV adoption in Australia is also shaped by broader environmental and policy considerations. While national policy settings vary, state-level initiatives and emissions targets continue to encourage the transition toward cleaner transport.

Public awareness of climate change and fuel price volatility further reinforces interest in electric vehicles. As these factors converge, EVs are becoming not just a technological choice, but a social and environmental statement.

What January 2026 Signals for the Rest of the Year

Industry analysts view January’s sales data as a strong indicator of what lies ahead in 2026. With multiple new models expected to launch and supply chains stabilizing, monthly EV volumes are likely to remain robust.

Competition is set to intensify, potentially leading to price adjustments, feature upgrades, and improved customer support. For consumers, this environment promises better value and more choice.

Read Also: EV Mitra Scheme 2025 India: Subsidy, Benefits, Eligibility & How to Apply

Challenges That Still Remain

Despite positive momentum, challenges persist. Charging access in remote regions, grid capacity concerns, and long-term battery recycling remain important issues that require continued attention.

Additionally, as more brands enter the market, quality assurance and after-sales service will play a crucial role in shaping consumer trust.

Addressing these challenges will be essential to maintaining growth and ensuring a smooth transition to electric mobility.

Conclusion: A New Chapter for Australia’s EV Market

The January 2026 EV sales data paints a picture of an Australian market at a pivotal moment. BYD’s rise, Tesla’s recalibrated position, and the growing presence of new brands collectively signal a shift toward a more competitive and inclusive EV ecosystem.

Electric vehicles are no longer a fringe choice in Australia. They are becoming a central part of the automotive landscape, driven by value, variety, and growing confidence in infrastructure.

As 2026 unfolds, Australia’s EV market appears poised for continued evolution—one defined not by a single dominant player, but by diverse competition and informed consumers shaping the future of mobility.